A few months ago, I met an old friend after many years.

On paper, he had “made it.”

Senior position. Big house. International travel. The kind of LinkedIn profile that makes people pause. Over coffee, he said quietly: “I earn more than I ever imagined. But I don’t remember the last time I had a free Sunday.”

That line stayed with me. Because it reveals something we rarely admit:

You can increase your income every year — and decrease your life at the same time.

Somewhere along the way, we confused net worth with wealth.

Maybe it’s time to expand the definition.

Wealth Is More Than a Bank Balance

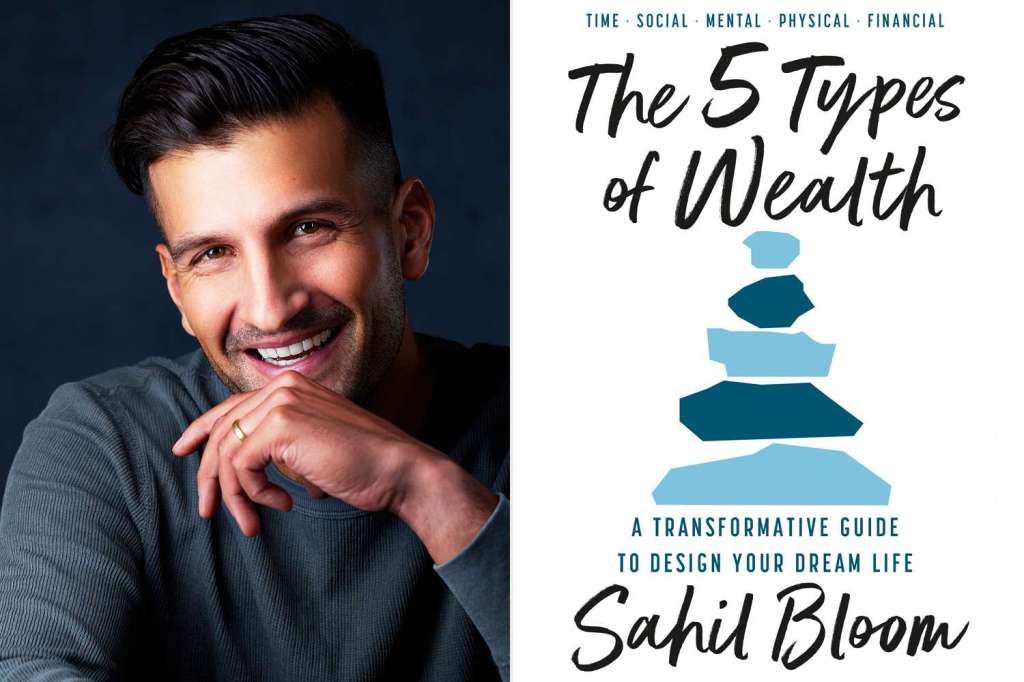

In ‘The 5 Types of Wealth’, Sahil Bloom suggests that wealth has five dimensions:

• Financial

• Time

• Social

• Mental

• Physical

Most of us optimize only one. Society rewards visible metrics. But the most important forms of wealth are invisible.

Imagine someone with ₹50 crore but no time for his children. Or someone who is financially free but constantly anxious. Or someone fit and successful but deeply lonely.

Would we call them wealthy?

It feels incomplete.

Wealth is not a single number.

It’s a portfolio.

Financial Wealth: Important — But Not Supreme

Money matters. Let’s not pretend otherwise. It reduces stress. It creates security. It gives optionality.

When you have enough money to pay your bills, handle emergencies, and not panic at every unexpected expense, your nervous system relaxes. You sleep better. You argue less. You think more clearly. Financial stress is one of the biggest sources of anxiety in modern life.

That’s why financial wealth matters.

In ‘The Psychology of Money’, Morgan Housel writes: “The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want today.’”

Look at that carefully. He doesn’t mention luxury cars. He doesn’t mention mansions. He doesn’t mention showing off. He talks about freedom. Financial wealth, at its best, buys autonomy. It buys the ability to say:

- No to a toxic job.

- No to a humiliating client.

- No to something that doesn’t align with your values.

That kind of freedom is powerful.

But here’s where things get tricky. If you don’t define what “enough” means, the chase never ends.

- You get a raise — and your lifestyle quietly upgrades.

- You buy a bigger house — and now the EMI is bigger.

- You earn more — and suddenly your peer group earns even more.

This is what psychologists call the hedonic treadmill. You run faster, but you stay in the same emotional place. Income rises. Expectations rise even faster.

Bill Perkins, in one of my most favourite book ‘Die with Zero’, pushes the idea further. He argues that money is not meant to be stored endlessly. It is meant to be converted into meaningful experiences at the right time.

A trip taken at 30 feels different from the same trip at 75.

Playing football with your child at 35 feels different at 60.

Energy has a timeline. Health has a timeline.

Experiences compound emotionally. The memory of a joyful trip can last decades. The warmth of shared laughter becomes part of your identity. But unused money sitting quietly in an account does not compound emotionally. It only compounds numerically.

Financial wealth, then, is like the foundation of a house. Without it, the structure feels shaky. With it, you feel secure.

But no one lives on the foundation alone.

You build rooms — relationships, purpose, health, time freedom.

You create space for laughter, rest, meaning.

Money supports the house. It is not the house.

The goal is to build a life that feels rich — not just a balance sheet that looks impressive.

Time Wealth: Who Owns Your Calendar?

In ‘Four Thousand Weeks’, Oliver Burkeman reminds us that the average human lifespan is roughly 4,000 weeks. That’s it.

Now pause.

If you are 45, you’ve already used around 2,300 weeks.

Suddenly, “I’ll do it later” sounds risky. In India, we are masters of postponement.

- “We’ll travel after retirement.”

- “I’ll take care of health once the kids settle.”

- “I’ll slow down once this project ends.”

- “I’ll spend more time at home once I reach the next level.”

Our parents’ generation often sacrificed time for stability. That made sense in a scarcity economy. But today, many professionals are earning more than their parents ever did — and yet have less free time than ever.

That’s the paradox.

Look around in any Indian metro city.

- Traffic eats 2–3 hours daily.

- Workdays stretch into nights.

- WhatsApp groups never sleep.

- Weekends become errand days.

We are financially upgrading — but time is shrinking.

Open your calendar.

Does it show space for:

- Morning walks?

- Unhurried meals?

- Long conversations?

- Silence?

If not, you may be financially comfortable but time poor. And time poverty is exhausting.

Time wealth is not about retiring to Goa at 60.

It is about:

- Protecting Sunday mornings.

- Leaving the office one hour earlier for dinner with family.

- Saying no to one unnecessary meeting.

- Scheduling health like a board meeting.

- Taking a real holiday — not a laptop-working holiday.

It is about agency.

Money can be earned again.

Titles can change.

Markets recover.

But your child’s childhood does not pause.

Your parents’ aging does not reverse.

Your own energy does not stay constant.

Time wealth means your days reflect your values.

Not someday.

Now.

So here’s the real question: In the middle of promotions, projects, and progress — Who owns your calendar?

Because in the end, your life is not measured in years. It is measured in how you spent your weeks.

Social Wealth: The People Who Sit at Your Table

For more than 80 years, researchers at Harvard tracked hundreds of people through their entire lives. This became one of the longest studies ever done on human happiness — the Harvard Study of Adult Development.

The conclusion was beautifully simple:

Good relationships keep us healthier and happier. Period.

Not fame.

Not money.

Not intelligence.

Connection.

Dr. Robert Waldinger, who now leads the study and wrote ‘The Good Life,’ explains something striking: loneliness increases the risk of early death at levels comparable to smoking. On the other hand, strong relationships lower stress, protect the heart, and even improve longevity.

Yet ironically, in modern professional life, relationships are often the first sacrifice.

- “I’ll call them later.”

- “We’ll meet next month.”

- “I’m too busy right now.”

One postponed call.

One missed dinner.

One anniversary celebrated over video instead of presence.

Years pass quietly.

Think about your own life.

Who are the five people you can call at 2 a.m. without hesitation?

That is wealth.

Who knows your fears — not just your achievements?

That is wealth.

Who sits at your dining table regularly — not for networking, but for belonging?

That is wealth.

So the real question is:

In the middle of growth, ambition, and targets — Are you also investing in the people who will sit at your table when the targets no longer matter?

Mental Wealth: Why Do You Do What You Do?

Viktor Frankl, in ‘Man’s Search for Meaning’, wrote: “Those who have a ‘why’ to live can bear almost any ‘how.’”

Frankl was not writing from comfort. He survived Nazi concentration camps. He observed that even in extreme suffering, people who had a reason to live — someone they loved, work they wanted to complete, a belief they held deeply — were more resilient. Purpose gave them psychological strength.

Think about that.

When you know why you are doing something, hardship feels different. Long hours feel different. Failure feels different.

Without meaning, even small stress feels heavy.

With meaning, even big stress becomes bearable.

Modern psychology supports this.

You can win on paper and still feel tired inside.

We see this everywhere.

High achievers who feel strangely empty.

Successful professionals who quietly ask, “Is this it?”

People who tick every box but feel disconnected from themselves.

In India, this is especially common in high-pressure careers. From childhood, many of us are taught to chase marks, ranks, prestigious degrees. Then promotions. Then financial milestones.

Metrics become the language of success. But metrics are not meaning.

You can run very fast in the wrong direction.

Mental wealth is about alignment.

It is asking:

Why am I doing this?

Whose dream am I chasing?

Does this work express who I really am?

Mental wealth :

- It is being able to sit quietly and not feel empty.

- It is working hard — but knowing why.

- It is failing — but not losing your identity.

You can win externally and still feel lost internally.

Mental wealth is not about positive thinking all the time.

It is about coherence.

It is knowing why you are running — not just how fast.

Because in the end, speed impresses others.

Meaning sustains you.

Physical Wealth: The Energy to Enjoy It All

Let’s talk about something we all know is important — but quietly postpone.

Health.

- Not six-pack abs.

- Not perfect diet charts.

- Not extreme fitness.

Just basic, steady physical well-being.

James Clear writes in ‘Atomic Habits’: “Every action you take is a vote for the type of person you wish to become.”

- A morning walk is a vote.

- Choosing sleep over scrolling is a vote.

- Saying no to one unnecessary late-night call is a vote.

These votes look small.

But they compound.

Health compounds exactly like money does.

You don’t become unhealthy in one day.

You don’t become fit in one week.

It is daily accumulation.

Here’s the brutal irony.

In our 30s and 40s, we sacrifice sleep and exercise to build financial wealth.

Late nights.

Stress eating.

Skipped workouts.

“Busy” as a badge of honor.

Then in our 50s and 60s, we spend financial wealth to repair damaged health.

Hospital bills.

Medication.

Stress-related conditions.

We trade time and health for money — and later trade money to buy back health. But health doesn’t fully reverse like bank balances can.

Your body is the platform on which every other form of wealth stands.

In India especially, lifestyle diseases are rising rapidly — diabetes, hypertension, heart disease — even among people in their 30s.

We celebrate promotions loudly.

We ignore blood reports quietly.

Physical wealth is not about extreme discipline. It is about consistency.

- Regular movement.

- Simple home-cooked meals.

- Adequate sleep.

- Periodic health checkups.

- Stress management.

It is about respecting your body not as a machine to extract productivity from — but as a long-term asset. In traditional Indian wisdom, the body is called a “temple.” Not for decoration — but for preservation. You cannot build a meaningful life in a neglected body. Because without energy, nothing feels rich.

So the real question is simple: Are you treating your body like a short-term tool — or a lifelong investment?

The Big Integration — Wealth Is a Portfolio

Imagine you are an investor.

Would you put 100% of your money into one single stock? Of course not.

If that stock crashes, your entire wealth collapses.

You diversify.

Some money in equity.

Some in debt.

Some in gold.

Some in real assets.

Why?

Because diversification reduces risk.

Now here’s the uncomfortable truth: Many professionals do the opposite with life.

They put 100% of their energy into one asset — career.

- Long hours.

- Constant hustle.

- Identity tied to designation.

- Self-worth tied to salary.

Career becomes the only stock in the portfolio.

And that is risky.

- If health fails — the system shakes.

- If relationships weaken — loneliness creeps in.

- If meaning disappears — burnout rises.

Wealth, when seen wisely, is a diversified portfolio of five assets:

- Financial stability — so you are not constantly anxious.

- Time autonomy — so you can choose how to live.

- Deep relationships — so you are supported.

- Inner meaning — so your effort feels purposeful.

- Physical vitality — so you have energy to enjoy it all.

We review investment returns quarterly. We rarely review life allocation.

So maybe the real measure of success is not:

“How much are you worth?”

But this:

Are you wealthy in the ways that actually matter?

Because at the end, nobody remembers the portfolio statement. They remember how they lived.

About the Author

Dr Mukesh Jain is a Gold Medallist engineer in Electronics and Telecommunication Engineering from MANIT Bhopal. He obtained his MBA from the prestigious management institute, the Indian Institute of Management Ahmedabad. He obtained his Master of Public Administration from the Kennedy School of Government, Harvard University along with Edward Mason Fellowship. He had the unique distinction of receiving three distinguished awards at Harvard University: The Mason Fellow award and The Lucius N. Littauer Fellow award for exemplary academic achievement, public service & potential for future leadership. He was also awarded The Raymond & Josephine Vernon award for academic distinction & significant contribution to Mason Fellowship Program. Mukesh Jain received his PhD in Strategic Management from IIT Delhi. His focus of research has been Capacity building of organizations using Positive psychology interventions, Growth mindset and Lateral Thinking etc.

Mukesh Jain joined the Indian Police Service in 1989, Madhya Pradesh cadre. As an IPS officer, he held many challenging assignments including the Superintendent of Police, Raisen and Mandsaur Districts, and Inspector General of Police, Criminal Investigation Department and Additional DGP Cybercrime, Transport Commissioner Madhya Pradesh and Special DG Police. He has also served as Joint Secretary in Ministry of Power and Ministry of Social Justice and Empowerment, Government of India. As Joint Secretary, Department of Persons with Disabilities, he conceptualized and implemented the ‘Accessible India Campaign’, launched by Hon’ble Prime Minister Shri Narendra Modi in December 2015. This campaign is aimed at creating accessibility in physical infrastructure, Transportation, and IT sectors for persons with disabilities and continues to be a flagship program of the Ministry of Social Justice and Empowerment, Government of India since 2015.

Dr. Mukesh Jain has authored many books on Public Policy and Positive Psychology. His book, ‘Excellence in Government, is a recommended reading for many public policy courses. A leading publisher published his book- “A Happier You: Strategies to achieve peak joy in work and life using science of Happiness”, which received book of the year award in 2022. His other books are : ‘Mindset for Success and Happiness’, ‘Seeds of Happiness’, and ‘What they don’t teach you at IITs and IIMs’.

He is a visiting faculty to many business schools and reputed training institutes. He is an expert trainer of “The Science of happiness”. He has conducted more than 250 workshops on the Science of Happiness at many prominent B-schools and administrative training institutes of India, including Indian School of Business Hyderabad/ Mohali, National Police Academy, IIFM, National Productivity Council etc.